Currency hedging in the context of bond funds is the decision by a portfolio manager to reduce or eliminate a bond funds exposure to the movement of foreign currencies. In this currency hedging guide were going to outline a few standard and out of the box currency risk hedging strategies.

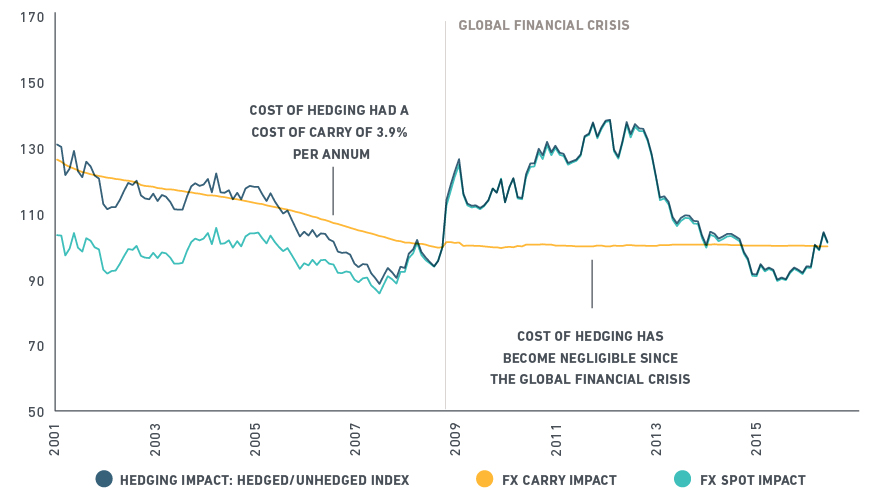

The Shrinking Cost Of Currency Hedging Msci

The Shrinking Cost Of Currency Hedging Msci

As a trader be it forex commodities stock or crypto there are basically two major strategies to follow when it comes to hedging.

Currency options are quoted by market participants who use several variables to determine the value of an option. Hedging is a way of protecting an investment against losses. Hedging can be used to protect against an adverse price move in an asset that youre holding.

Hedging is a strategy to protect ones position from an adverse move in a currency pair. In this case it wouldnt be exact but you would be hedging your usd exposure. When it comes to forex trading we can see hedging as a strategy which is used to protect ones position from an adverse move in a currency pair oppose to our original position.

! A foreign exchange hedge also called a forex hedge is a met! hod used by companies to eliminate or hedge their foreign exchange risk resulting from transactions in foreign currencies see foreign exchange derivative. 9 minutes this article will provide you with everything you need to know about hedging as well as what is hedging in forex an example of a forex hedging strategy an explanation of the hold forex strategy and more. This is done using either the cash flow hedge or the fair value method.

Forex hedging using currency options a currency option gives you the right to buy or sell a currency pair at a specific price some date in the future. Forex traders can be referring to one of two related strategies when they engage in hedging. A forex trader can make a hedge against a particular currency by using two different currency pairs.

It can also be used to protect against fluctuations in currency exchange rates when an asset is priced in a different currency to your own. What is forex hedg! ing and how do i use it. Hedging currency risk is a useful tool for any savvy investor that does business internationally and wants to mitigate the risk associated with the forex currency exchange rate fluctuations.

How Importers And Exporters Could Use A Forex Hedge To Minimise

How Importers And Exporters Could Use A Forex Hedge To Minimise

Foreign Currency Exposure And Hedging In Australia Bulletin

Foreign Currency Exposure And Hedging In Australia Bulletin

Advanced Fx Hedging Strategies And What Not To Do A Case Study

Advanced Fx Hedging Strategies And What Not To Do A Case Study

A Year In The Life Fx Management Treasury Today

! Foreign Exchange Hedging Tools

! Foreign Exchange Hedging Tools

Foreign Currency Hedging

Foreign Currency Hedging

The Fx Hedging Cycle How To Embed Best Practice Encorefx Canada

The Fx Hedging Cycle How To Embed Best Practice Encorefx Canada

Curren! cy Hedging How To Avoid Risk In Fx Fluctuations

Curren! cy Hedging How To Avoid Risk In Fx Fluctuations

Designing An Effective Fx Risk Management Policy

Designing An Effective Fx Risk Management Policy  Foreign Currency Exposure And Hedging In Australia Bulletin

Foreign Currency Exposure And Hedging In Australia Bulletin

Lower Foreign Currency Hedging Can Spell Trouble For Indian Firms

Lower Foreign Currency Hedging Can Spell Trouble For Indian Firms

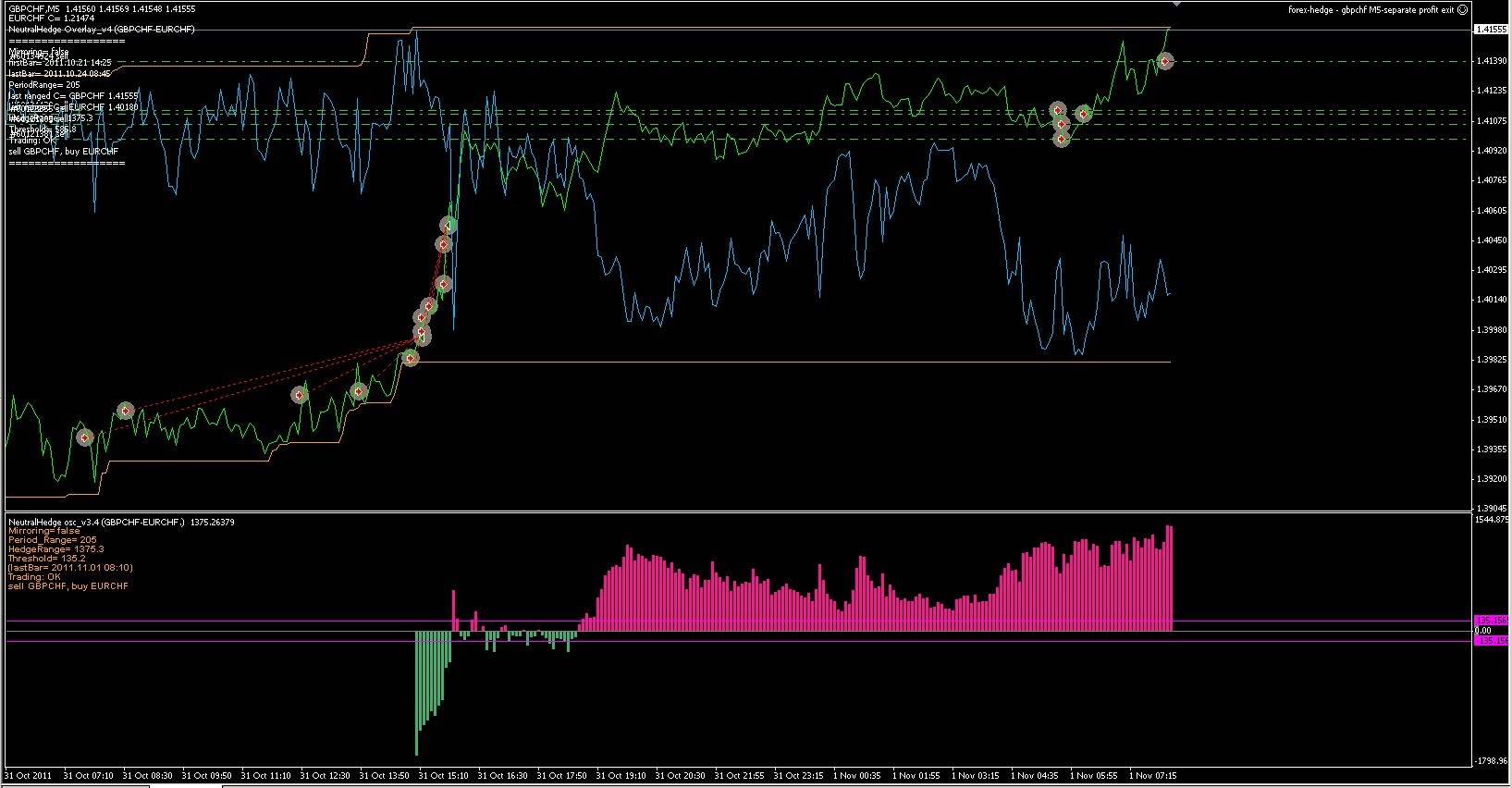

Currency Pairs Hedge Ea System Discussion Mq4 Ea Included Swing

Currency Pairs Hedge Ea System Discussion Mq4 Ea Included Swing

Foreign Currency Transactions And Hedging Foreign Exchange Risk

Foreign Currency Transactions And Hedging Foreign Exchange Risk

Fx Gains And Losses Series The Slippery Slope Of Unhedged Conversions

Fx Gains And Losses Series The Slippery Slope Of Unhedged Conversions

The Case For Hedging Currency Risk Through Basket Options

The Case For Hedging Currency Risk Through Basket Options